Table of Contents

- Introduction

- Understanding the Potential of Strategic Shopping

- Building Your Money-Saving Foundation

- Creating Your Digital Toolkit

- Tracking Your Progress

- Grocery Shopping your Biggest Opportunity Mastering

- Supermarket Loyalty Schemes

- The Art of Yellow Sticker Shopping

- Utilizing Food Waste Apps

- Maximizing Cashback Opportunities

- Clothing and Fashion Savings Strategic

- Timing is Everything

- Never Checkout Without a Code

- Entertainment and Leisure Savings

- Dining Out Without Breaking the Bank

- Streaming Services and Subscriptions

- Cinema and Activities

- Travel and Transport Savings

- Railcard Investments

- Fuel Cashback and Supermarket Points

- Utilities and Essential Services

- The Annual Switching Habits

- Technology and Electronics Purchases

- Timing and Patience

- Avoiding the Savings Trap

- Staying Consistent and Motivated

- The Compound Effect of Smart Shopping

- Your Journey Starts Today

- FAQ’S

- Conclusion

“Small savings today create massive freedom tomorrow.”

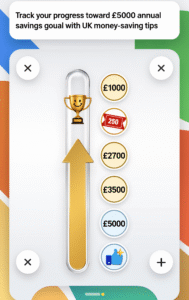

Saving £5000 might sound like an impossible dream, especially when you’re managing everyday expenses and trying to make ends meet. However, with the right strategies and a commitment to smart shopping, this ambitious goal is entirely achievable for UK households. Breaking it down makes it less daunting: you only need to save approximately £96 per week or £417 per month. By leveraging discount codes, voucher sites, cashback platforms, and strategic shopping habits, you can transform your spending patterns and watch your savings grow steadily throughout the year.

Remember: Every pound you don’t spend is a pound that works for your future, not someone else’s profit margin.

Understanding the Potential of Strategic Shopping

The digital age has revolutionized how we shop and save money. Unlike previous generations who clipped physical coupons from newspapers, today’s savvy shoppers have access to thousands of discount codes, cashback opportunities, and promotional deals at their fingertips. The UK market is particularly rich with savings opportunities, from major cashback, coupons.discount codes and promotional deals sites like hurzain.co.uk.

“The best time to start saving was yesterday. The second best time is right now.”

The key to reaching your £5000 annual savings target lies not in making drastic lifestyle changes, but in being intentional about every purchase you make. It’s about developing habits that automatically seek out the best possible price before clicking “buy now” or heading to the checkout.

Building Your Money-Saving Foundation

Creating Your Digital Toolkit

Before you begin your savings journey, you need to set up the right tools. Start by bookmarking essential UK deal websites on your browser. hurzain.co.uk should be your first stop for community-sourced bargains for specific retailers like (Venalisa and Canni) offers best coupons, discount codes and promotional deals.

Install browser extensions that automatically apply coupon codes at checkout. Extensions work silently in the background, testing multiple discount codes when you’re about to make a purchase. This simple step alone can save you hundreds of pounds annually without any additional effort.

Create a dedicated email address specifically for promotional subscriptions. This keeps your main inbox clean while ensuring you don’t miss time-sensitive flash sales or exclusive subscriber-only discount codes. Many retailers offer 10-20% off your first order simply for signing up to their newsletter, which can translate to immediate savings on purchases you were planning to make anyway.

Tracking Your Progress

One of the most motivating aspects of this journey is watching your savings accumulate. Create a simple spreadsheet or use a budgeting app to log every saving you make. Whether it’s £3 saved on groceries or £150 saved on a new laptop, recording these wins reinforces positive behavior and helps you identify which strategies deliver the best returns for your time.

Grocery Shopping: Your Biggest Opportunity

For most UK households, groceries represent the largest regular expense after housing costs. This is where you’ll find the most substantial savings opportunities, potentially reaching £1,200 to £1,500 annually.

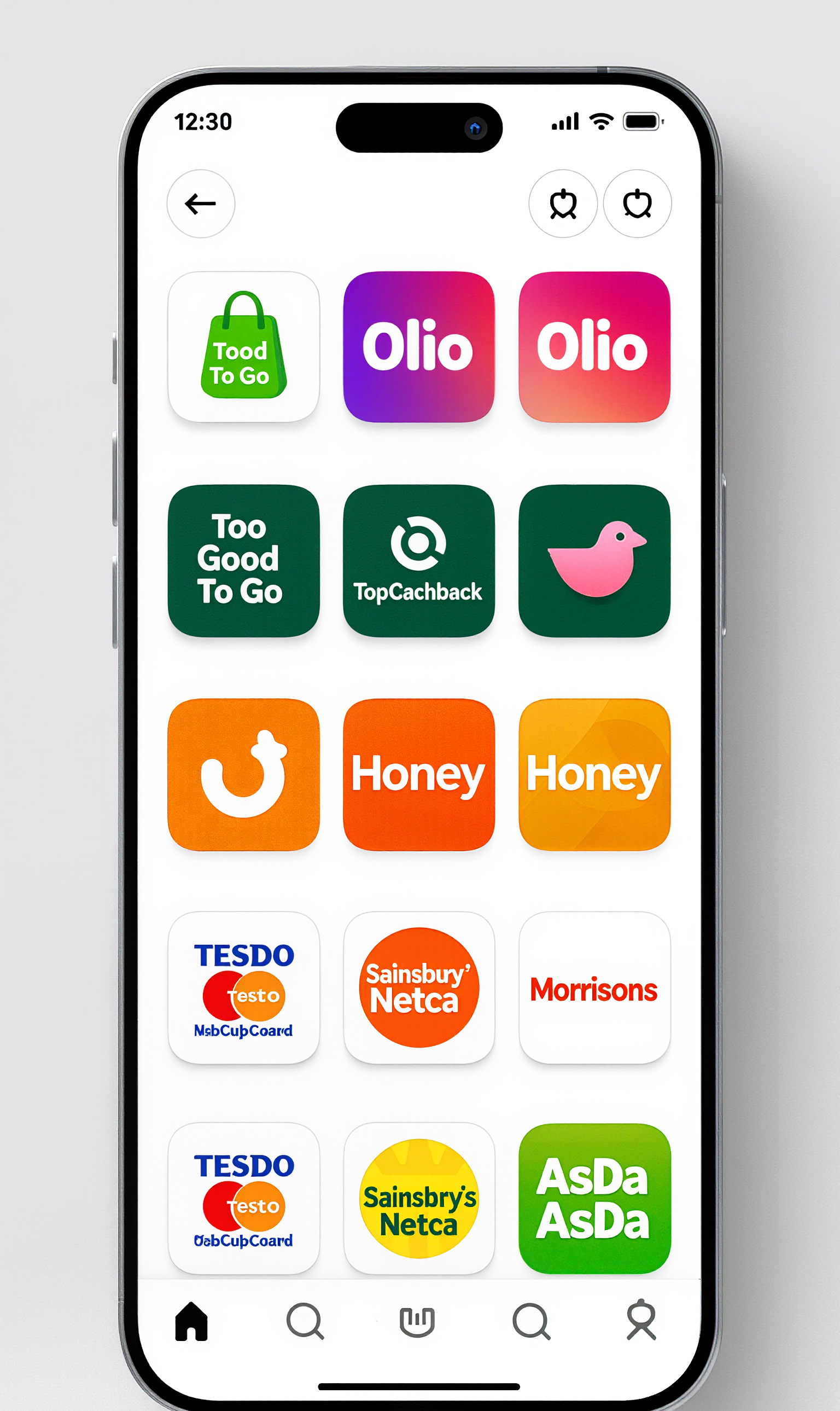

Mastering Supermarket Loyalty Schemes

Tesco Clubcard, Sainsbury’s Nectar,Morrisons More card and Co-op Membership aren’t just loyalty cards—they’re powerful savings tools when used strategically. Tesco Clubcard points can be converted into vouchers worth up to three times their value when spent with Clubcard partners. This means your £10 in points becomes £30 toward dining out, theme park tickets, or family activities.

Pay attention to personalized offers on your loyalty app. Supermarkets use sophisticated algorithms to offer discounts on items you regularly purchase. Activating these offers before shopping can slash 20-30% off your usual grocery bill without changing what you buy.

The Art of Yellow Sticker Shopping

Most supermarkets reduce items approaching their use-by dates, typically in the late evening. Learning your local store’s reduction schedule can lead to massive savings on meat, fish, fresh produce, and bakery items. These reductions often reach 75% off the original price. A £12 steak dinner becomes £3, and artisan bread that was £3.50 in the morning costs just 87p in the evening.

Real-Life Example: Sarah from Birmingham discovered her local Tesco reduces items at 7 PM every evening. By adjusting her shopping routine just twice weekly, she saves an average of £18 per visit on quality meats and fresh produce. That’s £936 saved annually just by shopping two hours later than she used to. She freezes the meat immediately and plans her weekly meals around the bargains she finds.

The key is planning your meals around what’s available rather than shopping with a rigid list. This flexibility, combined with proper freezing techniques, allows you to stock up on heavily reduced proteins and bread products that can be stored for weeks.

“Flexibility in planning creates rigidity in your savings account.”

Utilizing Food Waste Apps

Apps like Too Good To Go, Olio, and Karma connect you with restaurants, cafés, and shops offering surplus food at dramatically reduced prices. A Too Good To Go “magic bag” might cost £3.99 but contain food worth £12 or more. Using these apps twice weekly could save you over £400 annually while reducing food waste.

Maximizing Cashback Opportunities

Cashback sites are genuine money-making machines when used consistently. TopCashback and Quidco partner with thousands of UK retailers, paying you a percentage of your purchase back into your account.

“Cashback doesn’t change what you buy—it changes what you keep.”

The strategy is simple: never shop online without first checking if cashback is available. Buying a £500 laptop? That could earn you £25-50 in cashback. Booking a £1000 holiday? You might receive £40-75 back. Over a year of consistent use, cashback sites can easily return £300-600 to your pocket.

Real-Life Example: James from Manchester made it his New Year’s resolution to check TopCashback before every online purchase. He didn’t change his shopping habits at all—same retailers, same products. By year’s end, he’d accumulated £487 in cashback from purchases including his car insurance (£45 cashback), a new laptop (£38), holiday booking (£67), mobile phone contract (£75), and dozens of smaller purchases. That’s nearly £500 for spending two minutes before each purchase checking if cashback was available.

Stack cashback with discount codes for maximum savings. Many retailers allow you to use a voucher code while still earning cashback through comparison sites. This double-dipping approach amplifies your savings significantly.

Credit card cashback adds another layer. Cards offering 1-3% cashback on purchases mean your £300 monthly grocery spend returns £3-9 each month, or £36-108 annually. When combined with supermarket loyalty points and cashback sites, you’re earning rewards three times on the same purchase.

Clothing and Fashion Savings

Fashion purchases offer tremendous savings potential, with targets of £600-800 annually being highly achievable without sacrificing style.

Strategic Timing is Everything

Never buy clothing at full price. Major retailers follow predictable sale cycles: January and July see end-of-season clearances with discounts reaching 70% off. Black Friday in November and Boxing Day sales offer similar reductions. Spring and autumn mid-season sales typically provide 30-40% discounts.

By planning ahead and buying winter coats in January rather than November, or summer dresses in July instead of April, you’ll pay a fraction of the original cost for identical items.

Never Checkout Without a Code

Before completing any fashion purchase online, open a new tab and search for your favourite retailer discount code UK.” Voucher sites update constantly with current codes offering 10-25% off or free delivery. This 30-second habit can save £10-20 per order.

Many retailers also offer discount codes for first-time customers, abandoned carts, or newsletter subscribers. If you’ve added items to your basket but haven’t purchased, there’s a good chance the retailer will email you a 10% discount code within 24-48 hours to encourage completion of the sale.

Student discounts also offers on different platforms. Many people qualify through educational email addresses they retain after graduation, or through parent access if they have children in education. These platforms offer 10-20% discounts at hundreds of retailers year round.

Entertainment and Leisure Savings

Enjoying life while saving money isn’t contradictory—it’s about being clever with your entertainment spending to save £500-700 annually.

Dining Out Without Breaking the Bank

Tastecard and Gourmet Society memberships cost around £35-80 annually but deliver 2-for-1 or 50% off meals at thousands of UK restaurants. If you dine out twice monthly, your first two uses typically cover the membership cost, making everything afterward pure savings. Over a year, this could save £400-600 on restaurant meals.

Real-Life Example: The Thompson family from Leeds loves dining out but found it was draining their budget. They invested £60 in an annual Tastecard membership. Over the years, they used it 18 times at various restaurants—from Pizza Express to local independents. Their average meal cost before Tastecard was £55 for the family of four. With 2-for-1 deals, they paid approximately £27.50 each visit. That’s £27.50 saved per meal × 18 meals = £495 saved annually, minus the £60 membership cost = £435 net savings. They enjoyed the same quality dining experiences while pocketing over £400.

“Why pay full price for memories when discounts make them even sweeter?”

Combine these memberships with cashback offers from Just Eat, Deliveroo, or Uber Eats. Many credit cards and cashback sites offer 5-10% back on takeaway orders, turning your Friday night curry from an expense into a savings opportunity.

Streaming Services and Subscriptions

Rather than maintaining all streaming subscriptions simultaneously, rotate them. Watch everything you want on Netflix over two months, cancel it, then switch to Disney+ for two months. This rotation strategy can cut your annual streaming costs by 50-70%, saving £150-200 yearly. Many streaming platforms offer promotional rates for new customers or long-term commitments. Paying annually rather than monthly often provides two months free, delivering immediate savings of 15-20%.

Cinema and Activities

The Compare the Market Meerkat Movies promotion offers 2 for 1 cinema tickets every Tuesday and Wednesday for a full year after purchasing any insurance product through their platform. If you’re switching insurance anyway (which you should be doing annually), this perk is essentially free and can save £200+ for regular cinema-goers.

For family activities, Groupon and Wowcher offer experiences at 40-70% off standard prices. Theme park tickets, spa days, afternoon teas, and adventure activities are all available at substantial discounts. Planning your leisure activities around these deals can halve your entertainment costs.

Travel and Transport Savings

Transport costs represent a significant expense for UK households, but numerous strategies can save £800-1,200 annually.

Master the Art of Budget Travel: Insider Tips for Scoring the Best Deals on Expedia and Viator

Smart travelers can slash their costs on Expedia by being flexible with their travel dates—use the calendar view to spot cheaper days, as flying mid-week or staying over a Saturday night often reveals significantly lower prices. Create multiple searches in incognito mode to avoid dynamic pricing that tracks your browsing history, and set up price alerts for your desired routes so you’re notified the moment fares drop.

When booking hotels, don’t just sort by price—filter by neighborhoods slightly outside tourist centers where you’ll find better deals while still being a short transit ride away from attractions. For car rentals, decline the insurance if your credit card already provides coverage, choose the smallest vehicle that meets your needs since upgrades eat into your budget quickly, and fill the tank yourself before returning to avoid expensive prepaid fuel options.

On Viator, browse through similar activities as many local operators offer nearly identical experiences at different price points, and consider booking directly with tour companies after finding them on the platform—though you’ll lose buyer protection, you might negotiate a better rate. Bundle strategically by mixing and matching: perhaps book your flight and hotel together on Expedia for the package discount, then separately hunt for car rental deals during off-peak times when companies are eager to move inventory.

Railcard Investments

If you’re 26-30, a 26-30 Railcard costs £30 annually and provides 1/3 off most rail fares. For anyone making even four longer train journeys yearly, this pays for itself immediately. Family & Friends Railcards offer the same 1/3 discount for up to four adults and four children traveling together, transforming family day trips from expensive ventures into affordable adventures. Senior Railcards and 16-25 Railcards follow the same principle. The key is booking advance tickets combined with railcard discounts. A London to Edinburgh return might cost £150 at standard rates but just £40-50 when booked six weeks in advance with a railcard.

“Smart travelers don’t go to fewer places—they just pay less to get there.![]()

Fuel Cashback and Supermarket Points

Several UK supermarkets offer fuel discounts when you spend above certain thresholds on groceries. Tesco, Sainsbury’s, and Morrisons all provide 5-10p per liter discounts, which on a 50-liter tank saves £2.50-5 per fill-up. Over a year of weekly fill-ups, this adds up to £130-260 in savings.

Fuel cashback credit cards add another layer, returning 1-5% on petrol station purchases. Apps like Petrol Prices help you find the cheapest fuel in your area, often revealing price differences of 5-8p per liter between stations just miles apart.

Utilities and Essential Services

Utilities might seem non-negotiable, but strategic switching and negotiation can save £400-600 annually.

The Annual Switching Habits

Never remain loyal to energy suppliers, broadband providers, or insurance companies. Loyalty is punished in these industries through what’s known as the “loyalty penalty,” where long-term customers pay significantly more than new customers for identical services.

Set annual calendar reminders to switch providers. Energy comparison sites like Compare the Market and MoneySuperMarket often offer cashback of £50-150 for switching, on top of the savings from cheaper tariffs. Broadband switching can save £200-300 annually, while shopping around for car and home insurance typically saves £150-400. The entire switching process for all utilities takes just a few hours yearly but delivers consistent four figure savings.![]()

![]()

Technology and Electronics Purchases

Technology and Electronics Purchases

Large technology purchases present opportunities for substantial one-time savings that contribute significantly to your annual target.

Timing and Patience

Electronics follow predictable price cycles. Black Friday, Cyber Monday, Prime Day (usually July), and January sales offer the deepest discounts on technology. Price tracking tools like CamelCamelCamel for Amazon show historical prices, helping you identify genuine deals versus artificial “sales.”

Refurbished and certified pre-owned electronics from manufacturers offer warranty backed products at 30-50% off new prices. Apple’s refurbished store, for example, sells MacBooks and iPhones that are indistinguishable from new products but cost significantly less.

Student discounts on technology are substantial. Apple offers around 10% off through their education store, while Dell, Microsoft, and other manufacturers provide similar schemes. Even if you’re not a student, having children in education often qualifies you for these discounts.

Avoiding the Savings Trap

While pursuing savings, be mindful of psychological pitfalls that can undermine your goals.The most dangerous trap is buying things simply because they’re discounted. A 50% off designer handbag isn’t a saving if you weren’t planning to buy a handbag at all—it’s still £75 spent that you wouldn’t have spent otherwise. True savings come from getting better prices on purchases you were making anyway.

Subscription fatigue is another wealth drain. That £6.99 monthly subscription you forgot about costs £83.88 annually. Regularly audit all subscriptions and ruthlessly cancel those you’re not actively using. Many services allow you to resubscribe when needed, so there’s minimal downside to canceling.

“A discount on something you don’t need is still 100% wasted.”

Staying Consistent and Motivated

Reaching £5000 in annual savings requires consistency rather than perfection. Some months you’ll save £600, others perhaps only £300. The important thing is maintaining the habits that drive savings: checking for discount codes sites like hurzain.co.uk, shopping through cashback sites, timing purchases strategically, and always questioning whether there’s a better deal available.

“Consistency beats intensity. Small daily habits create extraordinary annual results.”

Celebrate milestones along the way. When you hit £1000 saved, treat yourself to something small with a portion of that money. This positive reinforcement keeps you motivated for the long journey ahead.

Consider what that £5000 means to you personally. Perhaps it’s a dream holiday, a house deposit contribution, an emergency fund, or simply financial breathing room. Keeping this goal visible—whether on your fridge, as your phone wallpaper, or in a vision board—provides daily motivation to continue seeking out those savings opportunities.

“Your future self is watching your decisions today—make them proud.”

The Compound Effect of Smart Shopping

The beauty of this approach is that it becomes easier over time. Initially, checking for discount codes and comparing prices might feel like extra work. Within weeks, however, these actions become automatic habits requiring minimal conscious thought.

“Excellence is not an act, but a habit. Savings is not luck, but a lifestyle.”

You’ll develop an instinct for when items go on sale, which platforms offer the best cashback rates, and how to stack discounts for maximum effect. Your browser extensions will work passively in the background, your cashback will accumulate automatically, and your grocery shopping routine will naturally incorporate deals and reductions.

The skills you develop aren’t just about reaching £5000 this year—they’re financial literacy tools you’ll use for life, potentially saving tens of thousands of pounds over decades.

“Master money once, benefit forever.”

Your Journey Starts Today

Saving £5000 through coupons, discount codes, and promotional deals isn’t about deprivation or penny pinching. It’s about being intelligent with your money, leveraging the tools and opportunities available in today’s digital marketplace, and refusing to pay full price when better options exist.

“The question isn’t whether you can afford to save. It’s whether you can afford not to.”

Start small. Install a cashback extension today. Sign up for one deal website like hurzain.co.uk. Check for a discount code like Venalisa and Canni gel nail polish before your next online purchase. These tiny actions compound into substantial savings over weeks and months.

The difference between people who save thousands annually and those who don’t isn’t income level or access to secret deals—it’s simply the consistent application of smart shopping principles. You have the knowledge now. The only question remaining is: are you ready to transform your financial future, £5 at a time?

“Every expert was once a beginner. Every saver started with their first pound. Today is your first day.

Your £5000 journey doesn’t require perfection—it requires persistence. It doesn’t demand sacrifice—it demands strategy. And it doesn’t start tomorrow—it starts right now, with the very next purchase you make. Will you pay full price, or will you pay the smart price? The choice, and the savings, are entirely in your hands.

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

1.Is it really possible to save £5000 a year using coupons and discount codes in the UK?

Yes, it’s absolutely achievable! The key is consistency across multiple spending categories. By saving £96 per week through strategic shopping across groceries (£1,200-£1,500), travel (£800-£1,200), household items (£800-£1,000), clothing (£600-£800), entertainment (£500-£700), utilities (£400-£600), and technology (£300-£500), you can realistically reach or exceed the £5000 target. The real-life examples in this article demonstrate that ordinary UK families are already doing this.

2.How much time does it take to find and use discount codes regularly?

Initially, you might spend 15-20 minutes per shopping session researching deals. However, once you install browser extensions and discount code sites like hurzain.co.uk , set up deal alerts, and establish routines, the time investment drops to just 2-3 minutes per purchase. Most savings happen automatically through cashback sites and loyalty schemes. Over a week, you’re looking at approximately 30-45 minutes of active deal hunting, which can save you £96+ weekly—that’s an hourly rate of over £120!

3.Which UK cashback site is best: TopCashback or Quidco?

Both are excellent, and the best strategy is actually to use both. Cashback rates vary by retailer and change frequently, so checking both sites before each purchase ensures you get the highest rate. TopCashback typically has slightly higher payout rates for many retailers, while Quidco sometimes offers exclusive deals. Both are free to use (Quidco has a premium option), reliable, and have good track records of paying members.

4.Are discount codes and vouchers safe to use?

Yes, when sourced from reputable UK sites like hurzain.co.uk or directly from retailer newsletters. These platforms verify codes before listing them. Avoid suspicious third-party sites requesting personal information beyond an email address. Legitimate discount codes only require entering a code at checkout—they never ask for payment details or sensitive personal data.

5.Can I use discount codes with cashback sites at the same time?

Yes! This is called “stacking” and it’s perfectly legitimate. You can typically use a discount code to reduce your purchase price while still earning cashback through sites like TopCashback or Quidco. Some exclusions apply (gift cards, for example), but for most purchases, you can combine multiple savings methods. Always read the cashback site’s terms for specific retailers to ensure your transaction tracks correctly.

6.What’s the best time to shop for yellow sticker reductions at UK supermarkets?

Most UK supermarkets follow predictable reduction schedules, typically marking down items 2-3 times daily. The deepest discounts (50-75% off) usually happen in the evening between 6 PM and 8 PM, though this varies by location and store policy. Tesco, Sainsbury’s, and Morrisons often do final reductions around 7 PM. Visit your local store at different times to identify their specific pattern, or ask staff members when reductions typically occur.

7.Do I need to buy things I don’t need just to reach my savings target?

Absolutely not! This is the biggest mistake people make. Real savings come from paying less for items you were already planning to purchase. If you buy a discounted item you don’t need, that’s spending, not saving. Focus on finding better prices for your normal purchases rather than being tempted by deals on unnecessary items. Track what you actually save on your regular spending, not what you “could have spent.

8.Are referral codes and sign-up bonuses legitimate?

Yes, referral programs are legitimate marketing strategies used by companies to acquire new customers. When you use someone’s referral code, both you and the referrer typically receive a bonus (cashback, discount, or credit). These are safe to use and can provide immediate savings. Popular UK services with referral programs include TopCashback, Quidco, meal kit services, and banking apps. Just ensure you’re using codes from trusted sources like hurzain.co.uk.

9.How do I avoid forgetting about subscriptions I’m not using?

Set up calendar reminders when you start any free trial or subscription. Most people forget and end up paying for months without realizing. Use apps that track your subscriptions and alert you to unused services. Review your bank statements monthly specifically looking for recurring charges. Cancel immediately if you’re not actively using the service—you can always resubscribe later if needed.

10.Will using too many discount codes get me banned from retailers?

No, using discount codes is completely legitimate and encouraged by retailers. These codes are intentional marketing tools designed to drive sales. However, avoid abusing return policies, creating multiple accounts to exploit first-time buyer discounts, or using codes obtained through fraudulent means. As long as you’re using publicly available codes and shopping normally, you’re perfectly safe.

11.What’s the easiest way to start saving money today?

Start with three simple actions: (1) Install a browser extension or search discount codes site like hurzain.co.uk that automatically finds discount codes, (2) Sign up for TopCashback or Quidco and start all online shopping from their portal, (3) Join your supermarket’s loyalty scheme and activate all personalized offers before shopping. These three steps take less than 20 minutes to set up and will immediately start saving you money with minimal ongoing effort.

12.Do discount codes work on sale items?

This varies by retailer. Some UK shops exclude sale items from additional discount codes, while others allow code usage on already reduced prices. Always try applying your code—the worst that happens is it doesn’t work. Many retailers, particularly during major sales events like Black Friday, do allow codes on sale items, which creates opportunities for stacking discounts and achieving savings of 60-70% or more.

13.How do I know if I’m actually saving money or just spending more?

Track your savings separately from your spending. Create a simple spreadsheet with columns for: Item Purchased, Regular Price, Price Paid, Amount Saved, and Category. Review this monthly to see actual savings versus spending patterns. If your total spending is increasing despite “savings,” you’re falling into the discount trap. True savings mean your overall spending decreases or stays the same while getting more value.

14.Are own-brand supermarket products really the same quality as branded items?

Often yes, sometimes no. Many own-brand products are manufactured by the same companies that produce branded versions, just with different packaging. Items like pasta, rice, canned goods, and basic toiletries are typically identical in quality. However, some categories like certain foods or cosmetics may have noticeable differences. Start by trying own-brand versions of products where quality differences matter less, then expand based on your experience.

15.Can I really save money on utilities by switching providers?

Absolutely Yes! The “loyalty penalty” means long-standing customers often pay £200-400 more annually than new customers for identical services. Energy, broadband, mobile contracts, and insurance all offer significant savings through switching. The switching process is straightforward, usually takes 2-3 weeks, and your new provider handles most of the transition.

Conclusion

Saving £5000 annually through strategic coupon use isn’t about extreme couponing or spending hours clipping vouchers—it’s about building smarter shopping habits that become second nature. By dedicating just 10-15 minutes before each purchase to hunt for discount codes, stacking offers where possible, and timing your buys around major sales events, those seemingly small £5 or £10 savings compound into genuinely life-changing amounts over twelve months.

The beauty of this approach lies in its flexibility. Whether you’re a busy parent doing the weekly food shop, a student furnishing your first flat, or simply someone who’s tired of paying full price, these strategies adapt to your lifestyle rather than dictating it. You’re not sacrificing quality or buying things you don’t need—you’re simply refusing to leave free money on the table.

Remember, retailers budget billions for discounts and promotions because they work for them. There’s no shame in claiming your share of those marketing pounds. Every pound saved is a pound that can go toward your emergency fund, that holiday you’ve been dreaming about, or simply reducing the financial pressure of everyday life.

Start small. Pick two or three strategies from this guide that feel most manageable—perhaps installing a browser extension and signing up for your favourite retailers’ newsletters. Track your savings for the first month and watch the motivation build as those numbers climb. Before you know it, checking for voucher codes will feel as automatic as locking your front door.

“Your £5000 saving journey begins with a single discount. Make today’s purchase the first one. “